Understanding ICCT Stock and Company Overview

What is ICCT stock? ICCT stock represents shares of iCoreConnect Inc., a technology company that trades on the NASDAQ exchange under the ticker symbol ICCT. The company specialises in cloud-based software and technology solutions, primarily serving healthcare and enterprise markets from its headquarters in Ocoee, Florida.

iCoreConnect has positioned itself as a technology innovator in the cloud software sector, focusing on secure communication and workflow solutions. The company’s business model centres around providing Software-as-a-Service (SaaS) solutions that help organisations streamline their operations and improve efficiency.

Current ICCT Stock Price and Market Performance

The ICCT stock price fluctuates throughout trading sessions, reflecting investor sentiment and market conditions. Investors closely monitor the stock’s daily performance, including pre-market and after-hours trading activity. The company’s market capitalisation, trading volume, and 52-week price range provide essential context for understanding the stock’s current valuation.

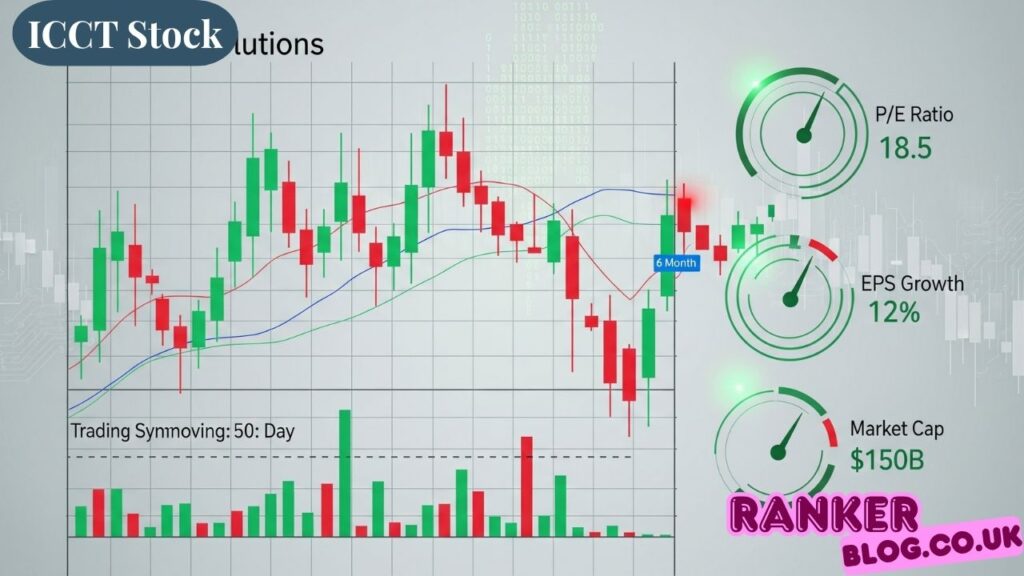

Key metrics that investors track include the price-to-earnings ratio, trading volume patterns, and the stock’s beta coefficient, which measures its volatility relative to the broader market. These fundamental indicators help investors assess whether the current stock price represents fair value.

Latest ICCT Stock News and Market Developments

ICCT stock news today often focuses on the company’s business developments, earnings reports, and strategic initiatives. Recent developments in the cloud software industry have significantly impacted investor perception of the company’s growth prospects.

The technology sector’s performance, regulatory changes affecting healthcare technology, and broader market conditions all influence ICCT stock news. Investors should stay informed about earnings announcements, partnership agreements, and product launches that could affect the stock’s trajectory.

Management announcements regarding new client acquisitions, revenue guidance updates, and expansion into new markets frequently drive trading activity. These developments provide insights into the company’s operational performance and future growth potential.

ICCT Stock Forecast and Future Projections

When considering the ICCT stock forecast, analysts evaluate multiple factors, including the company’s financial performance, market position, and industry trends. The ICCT stock prediction 2025 depends on several variables, including the company’s ability to execute its growth strategy and capture market share in the competitive cloud software space.

Technology stocks often experience higher volatility, making precise predictions challenging. However, analysts consider the company’s revenue growth trajectory, profitability improvements, and market expansion opportunities when developing their forecasts.

The ICCT stock prediction methodology typically involves fundamental analysis, technical chart patterns, and industry comparison studies. Investors should understand that predictions carry inherent uncertainty and should be considered alongside their own risk tolerance and investment objectives.

Investment Analysis: Is ICCT Stock a Good Buy?

Is ICCT stock a good buy? This question requires careful consideration of multiple factors. Potential investors should evaluate the company’s financial health, competitive position, and growth prospects within the cloud software industry.

The company’s revenue trends, profit margins, and cash flow generation capabilities provide essential insights into its financial stability. Additionally, the management team’s track record, strategic vision, and execution capability influence the investment thesis.

Risk factors include market competition, technological changes, and the company’s ability to scale operations profitably. Investors should also consider their portfolio diversification needs and risk tolerance when evaluating this technology stock.

Recent Developments and Market Impact

What happened to iCoreConnect stock? Understanding the stock’s historical performance helps investors contextualise current market conditions. The company has experienced various market cycles, influenced by both company-specific developments and broader technology sector trends.

Major price movements often correlate with earnings announcements, business development news, or changes in analyst recommendations. Investors benefit from understanding these historical patterns when making investment decisions.

The stock’s performance relative to technology sector peers and broader market indices provides additional context for evaluation. Comparing the company’s growth metrics with industry averages helps investors assess its competitive position.

Trading Strategies and Risk Management

Successful ICCT stocks trading requires understanding market dynamics and risk management principles. What is the 7% rule in stocks? This rule suggests that investors should consider selling a stock if it declines 7-8% from their purchase price, helping limit potential losses.

However, this rule should be applied thoughtfully, considering the stock’s volatility characteristics and the investor’s overall strategy. Technology stocks like ICCT often experience higher volatility, which may require adjusted risk management approaches.

Investors should develop clear entry and exit strategies, set appropriate position sizes, and maintain diversified portfolios to manage risk effectively. Regular portfolio review and rebalancing help ensure alignment with investment objectives.

Financial Performance and Valuation Metrics

iCoreConnect’s financial performance provides crucial insights for stock evaluation. Revenue growth trends, profitability metrics, and balance sheet strength influence investor confidence and stock price movements.

Key valuation metrics include price-to-earnings ratios, price-to-book ratios, and enterprise value comparisons with industry peers. These metrics help investors determine whether the current stock price represents attractive value or suggests overvaluation.

Cash flow analysis reveals the company’s ability to generate sustainable returns and fund future growth initiatives. Investors should monitor quarterly earnings reports and annual financial statements for performance updates.

Technology Sector Outlook and Market Positioning

The cloud software industry continues evolving rapidly, creating both opportunities and challenges for companies like iCoreConnect. Market demand for digital transformation solutions supports long-term growth prospects for well-positioned technology companies.

Competition from established software giants and emerging startups requires continuous innovation and market differentiation. iCoreConnect’s ability to maintain competitive advantages influences its long-term success prospects.

Industry trends, including artificial intelligence integration, cybersecurity requirements, and regulatory compliance needs, shape market opportunities. Companies that adapt effectively to these trends often outperform their peers.

Investment Considerations and Future Outlook

Investors considering ICCT stock should evaluate their investment timeline, risk tolerance, and portfolio objectives. Technology stocks can offer significant growth potential but often come with higher volatility and execution risks.

The company’s strategic initiatives, market expansion plans, and operational efficiency improvements will likely influence future stock performance. Monitoring these developments helps investors make informed decisions.

Long-term investors may focus on the company’s ability to build sustainable competitive advantages and capture market share in growing segments. Short-term traders might emphasise technical analysis and market sentiment indicators.

Conclusion

ICCT stock represents an investment opportunity in the growing cloud software market through iCoreConnect Inc. Investors should conduct thorough research, understand the associated risks, and consider how this investment fits within their overall portfolio strategy.

The technology sector’s dynamic nature requires continuous monitoring of company developments, industry trends, and market conditions. Successful investing in growth-oriented technology stocks often requires patience, discipline, and appropriate risk management.

Also Read: MathsBot: The Ultimate Mathematical Learning Platform for Primary Education