Introduction & Overview

In today’s rapidly evolving financial technology landscape, CycleMoneyCo has emerged as a game-changing force that’s transforming how businesses approach cash flow management. The latest post CycleMoneyCo published showcases groundbreaking innovations that are reshaping the fintech industry’s approach to working capital optimization.

CycleMoneyCo represents more than just another financial software company—it embodies a comprehensive solution for businesses struggling with cash flow inefficiencies. Their focus on optimizing business cash flow through modern fintech solutions has captured the attention of CFOs, financial managers, and business owners across various industries.

The significance of their recent update cannot be overstated, particularly for business owners and CFOs who are constantly seeking ways to improve their financial operations. This latest post CycleMoneyCo shared reveals innovative strategies that promise to revolutionize how companies manage their cash cycles and optimize working capital.

Understanding CycleMoneyCo’s Core Mission

Company Background

CycleMoneyCo operates as a specialized financial technology company with a laser focus on cash cycle optimization. Their primary mission revolves around helping businesses achieve maximum working capital efficiency through intelligent automation and data-driven insights.

The company targets businesses that are actively seeking to improve working capital efficiency, regardless of their size or industry. From small startups to large enterprises, CycleMoneyCo offers scalable solutions that cater to diverse business needs and financial complexities.

What sets them apart is their seamless integration of technology with real-time financial forecasting capabilities. This approach enables businesses to make informed decisions based on accurate, up-to-date financial data rather than relying on outdated spreadsheets or manual calculations.

Latest Post Key Highlights

The latest post CycleMoneyCo published emphasizes several critical areas that demonstrate their commitment to innovation in financial management. The automated receivables management system represents a significant leap forward in reducing manual intervention while improving collection efficiency.

Enhanced forecasting using machine learning algorithms showcases how the latest post CycleMoneyCo leverages artificial intelligence to predict financial trends and potential cash flow challenges before they become problematic. This proactive approach allows businesses to make strategic adjustments in advance.

The reduction in Days Sales Outstanding (DSO) highlighted in the latest post CycleMoneyCo demonstrates tangible results that businesses can expect when implementing their solutions. Lower DSO translates directly into improved cash flow and reduced financial stress for growing companies.

Cash Flow Optimization Fundamentals

Cash Conversion Cycle Explained

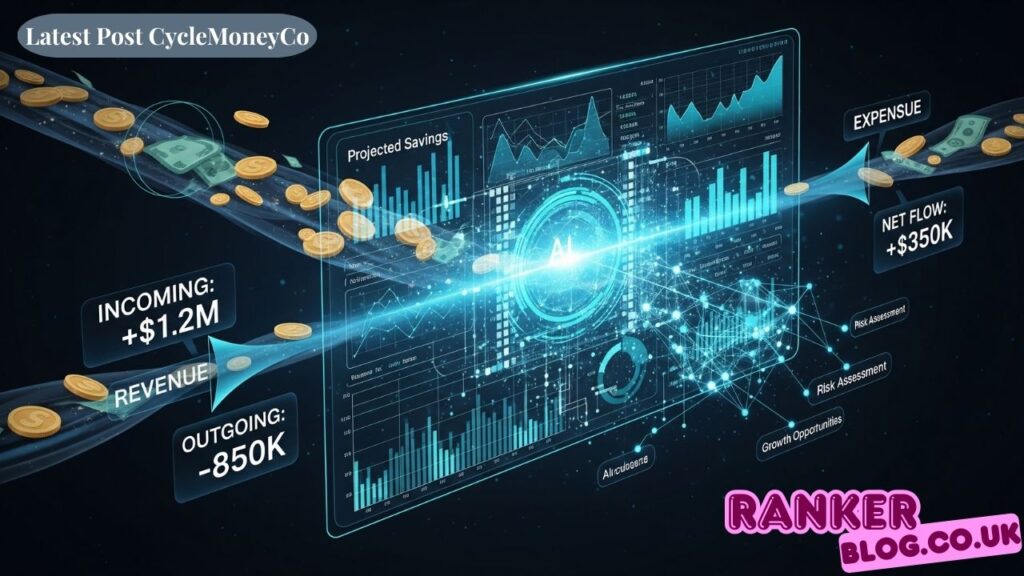

Understanding the cash conversion cycle is fundamental to appreciating the value proposition that CycleMoneyCo offers. The formula—DSO plus Days Inventory Outstanding minus Days Payable Outstanding—provides a clear metric for measuring cash flow efficiency.

The impact on business liquidity and growth potential cannot be understated. Companies with shorter cash conversion cycles enjoy greater financial flexibility, reduced borrowing requirements, and enhanced ability to reinvest profits into growth initiatives.

Shorter cycles enable faster reinvestment opportunities, creating a positive feedback loop that allows businesses to accelerate their growth trajectory while maintaining healthy cash reserves for unexpected opportunities or challenges.

CycleMoneyCo’s Approach

CycleMoneyCo’s methodology centers on AI-powered insights that help businesses predict and prevent financial bottlenecks before they impact operations. Their predictive analytics examine historical patterns and current trends to forecast potential cash flow issues.

Real-time analytics integration ensures that businesses always have access to current financial data, eliminating the delays and inaccuracies associated with traditional reporting methods. This immediate access to information enables faster decision-making and more agile financial management.

The automation of payment processes reduces manual errors while accelerating transaction processing. This systematic approach to payment management ensures consistent cash flow patterns and reduces the administrative burden on finance teams.

Technical Features & Capabilities

Platform Integration

One of the most impressive aspects revealed in the latest post CycleMoneyCo is their seamless integration capabilities with popular accounting platforms. Their integration with tools like QuickBooks, Xero, and NetSuite demonstrates their commitment to working within existing business ecosystems rather than requiring complete system overhauls.

The plug-and-play APIs facilitate quick implementation, allowing businesses to start benefiting from CycleMoneyCo’s features within days rather than months. This rapid deployment capability is particularly valuable for companies that need immediate improvements in their cash flow management.

The 70% reduction in manual reporting time within one quarter, as highlighted in the latest post CycleMoneyCo, represents substantial cost savings and efficiency improvements. Finance teams can redirect their efforts from manual data compilation to strategic analysis and planning.

AI and Machine Learning Components

Predictive analytics for cash flow forecasting represents the cutting edge of financial technology. CycleMoneyCo’s algorithms analyze multiple data points to provide accurate predictions about future cash flow patterns, enabling businesses to plan more effectively.

Payment behavior tracking enables businesses to understand their customers’ payment patterns, facilitating more accurate cash flow projections and improved relationship management. This insight allows companies to adjust their credit policies and collection strategies accordingly.

Automated invoicing systems ensure consistent and timely billing processes, reducing the delays that often occur with manual invoice generation. This automation contributes significantly to improved DSO and overall cash flow optimization.

Implementation Strategy

Getting Started

CycleMoneyCo recommends beginning with comprehensive financial audit procedures to establish baseline measurements and identify areas for improvement. This initial assessment provides the foundation for customizing the platform to each business’s specific needs.

Utilizing diagnostic tools helps businesses understand their current cash flow patterns and identify inefficiencies that may not be immediately apparent. These tools provide detailed insights into payment cycles, collection patterns, and cash flow bottlenecks.

Initial assessment procedures involve analyzing historical financial data to establish benchmarks and set realistic targets for improvement. This methodical approach ensures that implementations are tailored to achieve maximum impact for each business.

Optimization Tactics

Automated payables and receivables setup streamlines the entire payment cycle, reducing manual intervention while improving accuracy and speed. This automation ensures consistent processing and minimizes the likelihood of errors or delays.

Dynamic discount configurations allow businesses to incentivize early payments through automated discount offers, improving cash flow while maintaining positive customer relationships. These systems can adjust discount rates based on customer payment history and current cash flow needs.

Team training and onboarding support ensure that staff members can effectively utilize all platform features. CycleMoneyCo provides comprehensive training programs that help teams maximize their return on investment.

Competitive Analysis

Market Positioning

When comparing CycleMoneyCo with competitors like Bill.com, Tipalti, and Float, several unique selling propositions become apparent. Their comprehensive approach to cash cycle optimization sets them apart from solutions that focus on individual aspects of financial management.

Enterprise scalability advantages ensure that businesses can grow with the platform rather than outgrow it. This scalability is significant for rapidly expanding companies that need financial systems capable of handling increased transaction volumes.

Distinctive Features

Real-time forecasting capabilities provide businesses with immediate insights into their financial position and future cash flow projections. This real-time access to information enables more agile decision-making and better financial planning.

Predictive cash modeling utilizes advanced algorithms to project various financial scenarios, enabling businesses to prepare for different market conditions or growth trajectories. This capability is particularly valuable for strategic planning and risk management.

Data-rich insights delivery ensures that businesses receive actionable information rather than just raw data. The platform transforms complex financial information into clear, understandable reports that support informed decision-making.

Industry Applications

Target Industries

The latest post CycleMoneyCo specifically highlights their success with tech startups, eCommerce platforms, logistics firms, and service providers. These industries typically face unique cash flow challenges that traditional financial management tools struggle to address effectively.

High-transaction-volume businesses particularly benefit from CycleMoneyCo’s automation capabilities, as manual processing becomes increasingly inefficient as transaction volumes grow. The platform’s scalability ensures that processing capabilities keep pace with business growth.

Time-sensitive cash flow operations require the real-time insights and rapid processing capabilities that CycleMoneyCo provides. Industries where timing is critical appreciate the platform’s ability to accelerate financial processes without sacrificing accuracy.

Success Stories

Real-life client implementations demonstrate the practical benefits of CycleMoneyCo’s solutions across various industries. These case studies offer concrete examples of how businesses have enhanced their cash flow management and achieved tangible financial improvements.

Measurable ROI examples help potential clients understand the financial benefits they can expect from implementing CycleMoneyCo’s solutions. These quantifiable results provide compelling evidence of the platform’s effectiveness.

Cross-industry applications demonstrate the versatility of CycleMoneyCo’s platform, showcasing how its solutions can be tailored to meet the specific needs of various business types and industries.

Security & Compliance

Data Protection

The latest post CycleMoneyCo emphasizes their commitment to security through bank-grade encryption and SOC 2 compliance standards. These security measures ensure that sensitive financial data remains protected throughout all platform interactions.

Multi-layered authentication systems provide an additional layer of security that protects against unauthorized access while maintaining user convenience. These systems strike a balance between security requirements and operational efficiency.

Privacy safeguards for financial data ensure that businesses can trust CycleMoneyCo with their most sensitive information. Comprehensive privacy policies and data protection measures offer peace of mind for companies that handle confidential financial information.

Integration Safety

The non-replacement philosophy for existing accounting software ensures that businesses can enhance their current systems without requiring complete overhauls. This approach reduces implementation risks and preserves existing workflows.

Enhanced functionality approach means that CycleMoneyCo adds value to existing systems rather than replacing them entirely. This strategy minimizes disruptions while maximizing benefits for businesses that implement the platform.

System compatibility assurance ensures that CycleMoneyCo’s solutions work seamlessly with existing technology stacks, reducing integration challenges and technical complications.

Future Implications & Takeaways

Business Impact

Sustainable growth through better cash management represents the long-term value proposition that CycleMoneyCo offers. Businesses that implement effective cash flow management systems position themselves for consistent, sustainable growth.

Working capital strain reduction enables businesses to operate more efficiently and reduce financial stress. This improvement in economic health enables companies to focus on growth and innovation rather than cash flow concerns.

Hidden liquidity unlocking reveals cash flow opportunities that may not be immediately apparent through traditional analysis methods. CycleMoneyCo’s advanced analytics help businesses identify and capitalize on these hidden opportunities.

Action Steps

Understanding when to consider implementation is crucial for maximizing the benefits of CycleMoneyCo’s solutions. Businesses experiencing cash flow challenges, rapid growth, or increased transaction volumes should consider implementation sooner rather than later.

Growth phase optimization ensures that businesses implement cash flow management improvements at the optimal time in their development cycle. Early implementation provides maximum benefits as companies scale their operations.

Long-term financial planning benefits extend beyond immediate cash flow improvements to include strategic advantages that support sustained business growth and economic stability.

Conclusion & Call to Action

CycleMoneyCo’s innovative approach to cash flow optimization represents a significant advancement in financial technology solutions. The latest post CycleMoneyCo demonstrates their commitment to helping businesses achieve financial efficiency through intelligent automation and data-driven insights.

The key benefits of implementing CycleMoneyCo’s solutions include reduced DSO, improved cash flow predictability, automated financial processes, and enhanced decision-making capabilities. These advantages translate into tangible improvements in business operations and economic performance.

Implementation urgency considerations suggest that businesses should act promptly to capitalize on these technological advancements. As markets become increasingly competitive, companies that optimize their cash flow management gain significant advantages over those that rely on outdated financial processes.

The following steps for interested businesses include conducting initial assessments, evaluating current cash flow challenges, and exploring how CycleMoneyCo’s solutions can address their specific needs. Taking action now positions businesses for improved financial performance and sustainable growth in an increasingly competitive marketplace.

Also Read: Irish Business Systems A Comprehensive Guide for Modern Enterprises