Technology has made the modern world more accessible, streamlined, and automated. However, it is still hard to find a dependable stock trading platform. 5starsstocks .com has emerged as a data-based platform in 2023 and has quickly become one of the favorite choices of individual investors. Investors who prioritize reliable analysis go for this platform. However, is it really worth the hype? Should investors trust it in 2025? Let us explore this platform further and answer that question.

The advent of Artificial Intelligence in the fintech market has showcased astounding growth potential. A 2023 report indicates a phenomenal expansion from $6.7 billion to $22.6 billion by 2027. This terrific growth makes platforms such as 5starsstocks.com more significant than ever. In this platform, the investors get expert stock market analysis, tailored investment guidance, and particular stock recommendations.

Users can also browse through various categories of stocks, like 5starsstocks.com 3d printing stocks, 5starsstocks.com value stocks, and 5starsstocks.com passive stocks that cater to diverse trading approaches and risk levels. The user demographics of the platform relay an interesting story—it appeals to younger demographics, as around 40% of the overall users fall below the age of 35. Furthermore, around one-third of the overall users are students or first-time users.

What Is the Purpose of the Platform?

The primary goal of 5starsstocks .com is to democratize stock market investing by making professional-grade analysis accessible to everyday investors. The platform leverages artificial intelligence and machine learning algorithms to evaluate thousands of stocks across multiple sectors, providing users with actionable insights and investment recommendations.

At its core, 5starsstocks com aims to simplify the overwhelming process of stock selection. Instead of requiring users to manually analyze financial statements, market trends, and economic indicators, the platform does the heavy lifting. It processes vast amounts of market data in real-time and presents findings in an easy-to-understand format, particularly through its signature five-star rating system.

The platform serves as a bridge between sophisticated Wall Street analysis tools and the average retail investor. Whether someone is looking for 5starsstocks.com best stocks for long-term growth or seeking immediate opportunities with 5starsstocks.com buy now recommendations, the platform provides curated lists based on various investment strategies and risk profiles.

Is It an Analysis Tool or a Trading Platform?

This is an important distinction that many new users wonder about. 5starsstocks.com functions primarily as a stock analysis and research platform rather than a direct trading platform. Users cannot execute trades directly through the website. Instead, the platform provides research, recommendations, and educational content that investors can use to make informed decisions on their preferred brokerage accounts.

Think of 5starsstocks as a research assistant rather than a broker. The platform analyzes market conditions, evaluates individual stocks, and presents investment opportunities across various categories, including 5starsstocks.com dividend stocks, 5starsstocks.com healthcare stocks, and 5starsstocks.com military sector investments. Users then take these insights and execute trades through their existing brokerage accounts like Robinhood, TD Ameritrade, Fidelity, or any other platform they prefer.

This separation actually offers advantages. Users maintain control over their brokerage relationships and aren’t locked into a single ecosystem. They can leverage the analytical power of 5starsstocks com while enjoying the trading features, customer service, and account management tools of their chosen broker.

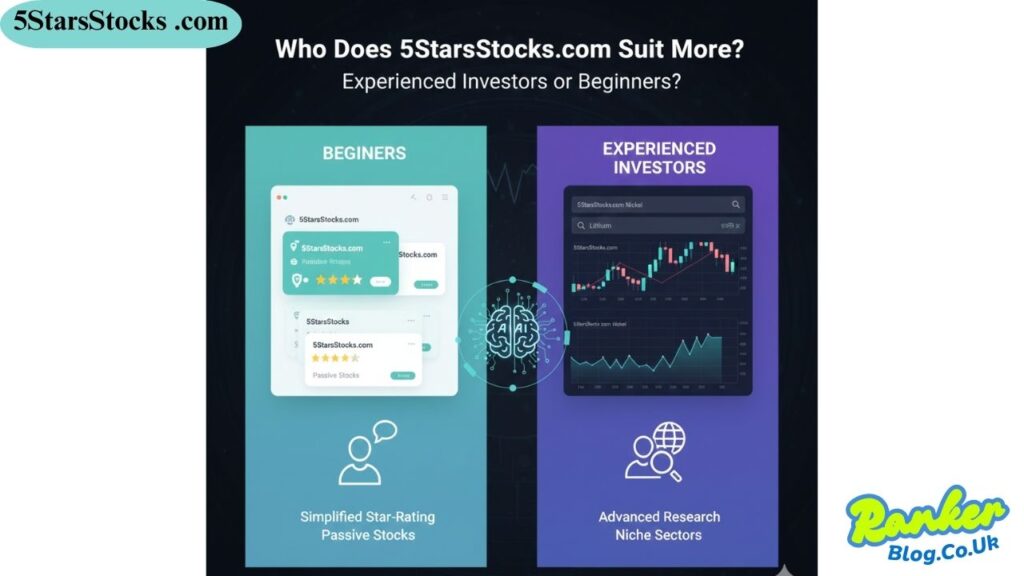

Who Does the 5starsstocks .com Suit More: Experienced Investors or Beginners?

The beauty of 5starsstocks.com lies in its versatility—it caters to both ends of the investor spectrum, though it particularly shines for certain user groups.

For Beginners: The platform offers tremendous value to novice investors who feel overwhelmed by the complexity of stock market investing. The simplified star-rating system removes much of the guesswork from stock selection. When a beginner sees 5starsstocks.com stocks rated with four or five stars, they understand immediately that the platform’s algorithms have identified these as strong investment candidates. The educational resources further help newcomers build foundational knowledge about different investment strategies.

Categories like 5starsstocks com passive stocks are especially beneficial for beginners who want to adopt a buy-and-hold strategy without constantly monitoring the market. Similarly, 5starsstocks best dividend stocks appeal to those seeking steady income rather than aggressive growth, which often represents a safer starting point for new investors.

For Experienced Investors: Seasoned traders and investors can use 5starsstocks.com as a supplementary research tool and idea generator. While experienced investors typically conduct their own due diligence, the platform can help identify opportunities they might have overlooked, particularly in niche sectors like 5starsstocks.com lithium or 5starsstocks.com nickel stocks that require specialized industry knowledge.

Experienced investors appreciate the time-saving aspect—instead of screening thousands of stocks manually, they can review the platform’s top recommendations and then conduct their own deeper analysis on the most promising candidates. The 5starsstocks com AI review capabilities can surface interesting investment opportunities in emerging sectors that might not be on every investor’s radar.

The Sweet Spot: The platform probably serves intermediate investors best—those who have some market experience and understand basic investment principles but want to enhance their research process with AI-powered insights. These users can critically evaluate the platform’s recommendations while benefiting from its analytical capabilities.

What are the Main Features of 5starsstocks .com?

Simple Interface and Navigation:

One of the standout aspects of 5starsstocks.com is its user-friendly design. The platform prioritizes simplicity without sacrificing functionality. Upon logging in, users encounter a clean dashboard that presents information in digestible chunks rather than overwhelming spreadsheets of data.

The navigation menu clearly organizes stocks into intuitive categories. Users can quickly jump to sections featuring 5starsstocks.com materials stocks, 5starsstocks.com defense opportunities, or 5starsstocks.com cannabis investments, depending on their interests and investment thesis. This categorical organization helps investors who have specific sector preferences or want to diversify across multiple industries.

The search functionality allows users to quickly locate specific companies or explore particular themes. Whether someone wants to investigate 5starsstocks.com blue chip stable performers or discover emerging opportunities in 5starsstocks.com 3d printing stocks, the search feature delivers relevant results promptly.

Color-coded indicators and visual elements make it easy to distinguish between different rating levels and risk categories. Even investors accessing the platform for the first time can navigate effectively without extensive tutorials or training.

AI-based Analysis of Stock and Forecasts:

The technological backbone of 5starsstocks .com is its artificial intelligence engine that continuously analyzes market data, company financials, economic indicators, and historical performance patterns. This AI system evaluates stocks across multiple dimensions, including financial health, growth potential, valuation metrics, and risk factors.

The platform’s algorithms consider both quantitative data (revenue growth, profit margins, debt levels, price-to-earnings ratios) and qualitative factors (management quality, competitive positioning, industry trends). This multi-factor approach provides a more holistic assessment than single-metric analysis.

For 5starsstocks.com income stocks, the AI specifically evaluates dividend sustainability, payout ratios, and the company’s history of maintaining or increasing dividends. When analyzing 5starsstocks.com value stocks, the algorithms identify stocks trading below their intrinsic value based on fundamental analysis.

The AI continuously learns and adapts as market conditions change. This dynamic approach means recommendations evolve based on current market realities rather than relying solely on historical patterns that may no longer apply.

Market Insights and Real-time Data:

5starsstocks com provides users with access to real-time market data, ensuring that investment decisions are based on current information rather than delayed quotes. The platform displays live stock prices, trading volumes, and percentage changes throughout the trading day.

Beyond individual stock data, the platform offers broader market insights, including sector performance comparisons, market trend analysis, and economic calendar events that might impact stock prices. Users can see which sectors are outperforming or underperforming, helping them make strategic allocation decisions.

The platform also provides context around its recommendations. Rather than simply listing 5starsstocks.com to buy opportunities without explanation, it offers insights into why particular stocks have earned high ratings. This transparency helps users understand the reasoning behind recommendations and develop their own analytical skills over time.

Market commentary and analysis help users understand the bigger picture. When examining 5starsstocks.com staples stocks, for instance, users receive information about consumer spending trends, economic conditions, and factors affecting the consumer staples sector broadly.

Educational Resources for New Investors:

Recognizing that many users are new to investing, 5starsstocks.com offers comprehensive educational content designed to build investing knowledge progressively. The educational section includes articles, guides, video tutorials, and webinars covering fundamental investing concepts.

Topics range from basic principles like understanding stock types and reading financial statements to more advanced subjects like technical analysis, portfolio construction, and risk management strategies. The content is written in an accessible language that doesn’t require a finance degree to understand.

For those interested in specific categories like 5starsstocks.com dividend stocks, dedicated educational content explains dividend investing strategies, how to evaluate dividend sustainability, and how to build an income-generating portfolio. Similarly, content about 5starsstocks com passive stocks teaches the principles of passive investing and long-term wealth building.

The platform also offers strategy guides for different market conditions, helping users understand when certain approaches (growth vs. value, aggressive vs. conservative) might be more appropriate. This educational component transforms 5starsstocks from merely a recommendation engine into a comprehensive learning platform.

Compatible with Niche Sectors Such as 3D Printing and Lithium:

While many stock analysis platforms focus primarily on large-cap, mainstream companies, 5starsstocks .com distinguishes itself by providing robust coverage of specialized and emerging sectors. This includes forward-looking industries that represent significant growth potential but require specialized knowledge to evaluate effectively.

The 5starsstocks.com 3d printing stocks category identifies companies pioneering additive manufacturing technologies across various applications, from aerospace to medical devices. The AI analyzes not just financial metrics but also patent portfolios, technological advantages, and market positioning within the 3D printing ecosystem.

Similarly, 5starsstocks.com lithium coverage focuses on companies involved in the lithium supply chain, which is critical to electric vehicle battery production and energy storage systems. As the world transitions toward electrification, lithium demand continues growing, and the platform helps investors identify well-positioned companies in this space.

The 5starsstocks.com nickel category serves investors interested in another critical battery metal, while 5starsstocks.com defense stocks appeal to those who believe in the investment thesis around increased global defense spending.

Other specialized categories include 5starsstocks.com healthcare stocks, which span pharmaceuticals, biotechnology, medical devices, and healthcare services. The 5starsstocks.com cannabis sector coverage addresses a controversial but rapidly evolving industry with significant regulatory and market dynamics.

This niche sector coverage is particularly valuable because individual investors often lack the time or expertise to deeply research specialized industries. The platform’s AI can process industry-specific information and identify the most promising opportunities within each sector.

What are the Pros and Caveats of 5starsstocks .com?

Pros

Comprehensive Sector Coverage: One of the biggest advantages of 5starsstocks.com is the breadth of its coverage. From established 5starsstocks.com blue chip companies to emerging opportunities in sectors like 3D printing and lithium, the platform offers something for every investment strategy. Investors can build diversified portfolios using recommendations across multiple sectors and risk profiles.

Time-Saving Research: For busy investors who don’t have hours to analyze financial statements and market reports, 5starsstocks com dramatically reduces research time. The AI does the heavy analytical lifting, presenting only the most promising opportunities. This efficiency is especially valuable for part-time investors who maintain careers outside of finance.

Accessible to All Skill Levels: The platform’s intuitive design and educational resources make it genuinely accessible to beginners while still offering value to experienced investors. The star-rating system provides simple guidance for novices, while detailed analysis and data satisfy more sophisticated users.

Regular Updates: 5starsstocks .com continuously updates its recommendations based on changing market conditions. Unlike static annual reports or quarterly updates, the platform’s AI processes new information daily, ensuring recommendations reflect current market realities.

Free Basic Access: The platform offers substantial functionality without requiring expensive subscription fees, making professional-grade analysis accessible to investors with limited capital. This democratization of investment research represents a significant advantage over traditional advisory services that might charge thousands of dollars annually.

Diverse Investment Strategies: Whether an investor seeks 5starsstocks.com income stocks for passive cash flow, 5starsstocks.com value stocks for bargain hunting, or growth opportunities in emerging sectors, the platform accommodates various investment philosophies and objectives.

Caveats

Limited Track Record: Launched in 2023, 5starsstocks.com has a relatively short operational history. While the platform has gained popularity quickly, it lacks the decades-long performance track record that established platforms like Morningstar or Zacks possess. Investors cannot evaluate how recommendations performed through multiple market cycles, bull markets, bear markets, and various economic conditions.

Methodology Transparency: The platform doesn’t fully disclose the specific algorithms and weighting factors its AI uses to generate ratings. While it mentions considering multiple factors, the exact methodology remains somewhat opaque. This lack of transparency makes it difficult for investors to fully understand or independently verify the rating system’s logic.

Moderate Trust Score: Independent website analysis tools have assigned 5starsstocks com a moderate trust score, suggesting some caution is warranted. While not indicating outright fraud or scam activity, this moderate rating suggests the platform hasn’t yet established the robust reputation and verification that comes with a longer operational history.

Aggressive Marketing: Some users have reported experiencing aggressive advertising tactics and pressure to make quick investment decisions. This approach contradicts sound investment principles that emphasize careful analysis and measured decision-making. Investors should be wary of any platform that encourages hasty financial decisions without thorough consideration.

No Regulatory Oversight: 5starsstocks.com operates without clear regulatory registration with entities like the Securities and Exchange Commission (SEC) or Financial Industry Regulatory Authority (FINRA). While the platform provides analysis rather than direct investment advice or brokerage services (which would require such registration), the absence of regulatory oversight means less accountability and fewer investor protections.

Performance Claims: Like many investment platforms, 5starsstocks .com may advertise impressive accuracy rates or historical performance. However, independent verification of these claims is limited. Past performance doesn’t guarantee future results, and investors should approach such claims with healthy skepticism.

Overreliance Risk: There’s a danger that users might rely too heavily on the platform’s recommendations without conducting independent research. No single source, regardless of how sophisticated, should be the sole basis for investment decisions. 5starsstocks.com works best as one tool among several in an investor’s research toolkit.

Is 5starsstocks .com legit?

This question understandably concerns many potential users considering whether to trust the platform with their investment research. The answer is nuanced—5starsstocks.com appears to be a legitimate service that provides stock analysis and recommendations, but it comes with important caveats that investors should understand.

What Does the Platform Offer?

5starsstocks com delivers real analytical value through its AI-powered stock evaluation system. The platform genuinely analyzes stocks across multiple factors and provides categorized recommendations across various sectors. Users do receive access to market data, stock ratings, and educational content as advertised.

The platform isn’t a scam in the sense of taking money without providing any service. It operates as a functioning stock research tool that many users find helpful in their investment process. The categories like 5starsstocks.com best stocks, 5starsstocks.com dividend stocks, and specialized sectors contain actual stock recommendations based on algorithmic analysis.

However, “legitimate” doesn’t automatically mean “optimal” or “superior to alternatives.” The platform is a real service, but investors should evaluate whether it meets their specific needs better than established alternatives.

Expert and User Feedback

The investment community’s assessment of 5starsstocks .com is mixed. Some users appreciate the platform’s accessibility, comprehensive sector coverage, and time-saving research capabilities. First-time investors particularly value the educational resources and simplified rating system that makes stock selection less intimidating.

However, more experienced investors and market analysts have expressed concerns. The lack of methodology transparency makes it difficult to assess the quality of the underlying analysis. The absence of a long-term performance track record means claims about accuracy and effectiveness cannot be thoroughly verified.

Independent financial experts generally recommend using 5starsstocks com as a supplementary research tool rather than a primary source for investment decisions. The consensus suggests cross-referencing the platform’s recommendations with other reputable sources, conducting independent fundamental analysis, and consulting with qualified financial advisors before making significant investment decisions.

Some users have reported that the platform’s 5starsstocks com AI review capabilities surface interesting investment ideas they hadn’t previously considered, particularly in niche sectors. However, these same users emphasize the importance of thoroughly vetting any recommendation before committing capital.

The platform’s marketing approach has drawn criticism, with some observers noting that legitimate investment tools typically don’t need to employ aggressive sales tactics. Sound investment platforms let their track record and methodology speak for themselves rather than pressuring users toward immediate action.

Red Flags to Consider:

- Absence of clear regulatory registration

- Limited transparency about analytical methodology

- Relatively short operational history

- Moderate trust scores from independent evaluators

- Reports of aggressive marketing tactics

Positive Indicators:

- Functional platform with real analytical capabilities

- Growing user base with some positive testimonials

- Educational resources that provide genuine value

- Coverage of diverse sectors and investment strategies

- Regular platform updates and improvements

The verdict? 5starsstocks.com appears to be a legitimate service that provides stock analysis, but it should be approached with appropriate caution and used as part of a broader research strategy rather than relied upon exclusively.

Conclusion

5starsstocks .com represents an interesting development in the democratization of investment research. By leveraging artificial intelligence to analyze stocks across multiple dimensions and presenting findings in an accessible format, the platform makes sophisticated analytical capabilities available to everyday investors who might otherwise lack access to such tools.

The platform’s strengths are clear: comprehensive sector coverage, including specialized areas like 5starsstocks.com materials, 5starsstocks.com healthcare, and 5starsstocks.com defense stocks; a user-friendly interface suitable for beginners; regular updates reflecting current market conditions; and educational resources that help users develop their investment knowledge. These features provide genuine value, particularly for newer investors building their analytical skills.

However, investors should approach 5starsstocks com with eyes wide open to its limitations. The short operational history means performance cannot be evaluated across different market cycles. The lack of methodology transparency makes independent verification difficult. The absence of regulatory oversight means fewer investor protections. These factors don’t necessarily disqualify the platform, but they do warrant caution.

The most prudent approach involves using 5starsstocks.com as one component of a diversified research strategy. Cross-reference recommendations with established platforms like Morningstar, Yahoo Finance, or seek guidance from qualified financial advisors. Use the platform to generate investment ideas and identify opportunities in categories like 5starsstocks.com to buy or 5starsstocks com passive stocks, but conduct your own due diligence before committing capital.

For investors interested in specialized sectors—whether 5starsstocks.com 3d printing stocks, 5starsstocks.com lithium opportunities, or 5starsstocks.com nickel investments—the platform can serve as a useful starting point for research. The AI’s ability to process industry-specific information and surface promising opportunities in niche areas adds value, especially for investors who lack specialized sector knowledge.

Remember that successful investing requires more than just following recommendations from any single source. It demands understanding your own risk tolerance, investment timeline, and financial goals. It requires diversification across sectors and asset classes. It necessitates emotional discipline to avoid panic selling during downturns or exuberant buying during bubbles.

Whether examining 5starsstocks.com value stocks for bargain opportunities, 5starsstocks best dividend stocks for income generation, or growth prospects in emerging industries, investors should maintain realistic expectations. No platform, regardless of how sophisticated its artificial intelligence, can eliminate investment risk or guarantee returns.

The investment landscape continues evolving, and platforms like 5starsstocks com will likely improve over time as they accumulate performance data, refine their algorithms, and build longer track records. For now, approach the platform as a helpful tool rather than a definitive oracle. Use it to supplement your research, generate ideas, and learn about different sectors and strategies, but always maintain the critical thinking and independent analysis that characterize successful long-term investors.

Ultimately, 5starsstocks.com can be a valuable resource when used appropriately—as part of a comprehensive research approach, with realistic expectations, and combined with sound investment principles. Whether you’re investigating 5starsstocks.com cannabis opportunities, 5starsstocks.com blue chip stability, or 5starsstocks.com income stocks for cash flow, remember that you, not any platform, bear ultimate responsibility for your investment decisions.

Also Read: QLCredit Your Complete Guide to Digital Lending and Credit Monitoring