Introduction: Transforming the Way People Approach Investing

In the rapidly evolving world of digital finance, finding a platform that truly simplifies investing while offering comprehensive tools can feel overwhelming. Enter gomyfinance invest, a revolutionary platform designed to make wealth-building accessible to everyone, regardless of their experience level or initial capital.

What is GoMyFinance Invest?

Gomyfinance invest is an innovative online investment platform that bridges the gap between traditional investing and modern financial needs. The platform serves as a one-stop solution where users can manage investments, track expenses, and build wealth through a user-friendly interface. Unlike conventional investment platforms that often intimidate newcomers with complex jargon and high entry barriers, this platform welcomes users with open arms and straightforward tools.

Platform Launch and Background

Founded in 2024, the platform emerged during a time when retail investors were seeking more transparent and accessible investment solutions. The creators recognized a significant gap in the market: millions of people wanted to invest but felt excluded by minimum deposit requirements, confusing interfaces, and a lack of educational support. Gomyfinance.com invest was built from the ground up to address these pain points directly.

Mission: Making Investing Accessible and Simple for Everyone

The core mission driving the platform is simple yet powerful—democratizing access to financial markets. The team behind gomyfinance invest believes that everyone deserves the opportunity to build wealth and secure their financial future. This philosophy translates into every feature, from the minimal $10 starting requirement to the comprehensive educational resources available to all users.

Target Audience: Beginners to Experienced Investors

Whether someone is making their first investment or managing a diverse portfolio worth thousands, the platform caters to all experience levels. College students learning about compound interest, young professionals planning for retirement, and seasoned traders seeking advanced tools all find value in what the platform offers. This inclusive approach sets it apart from competitors who often target only specific investor segments.

Overview of Platform’s Comprehensive Financial Ecosystem

Gomyfinance.com invests goes beyond basic investing. The platform integrates multiple financial management tools into one cohesive ecosystem. Users can track investments, manage budgets, monitor credit scores, and analyze spending patterns—all from a single dashboard. This holistic approach recognizes that successful investing doesn’t happen in isolation; it requires understanding one’s complete financial picture.

Platform Overview & Core Features

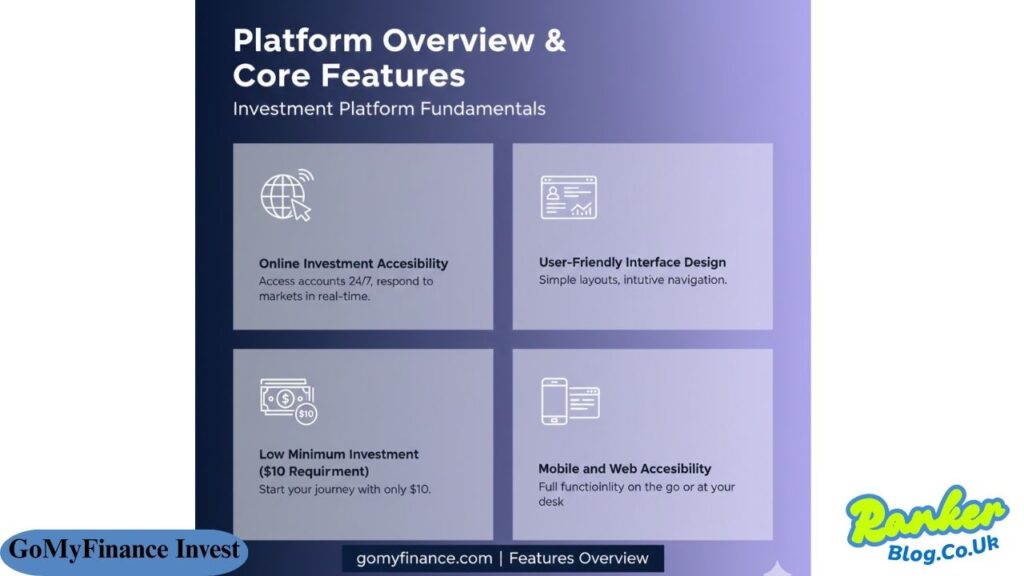

Investment Platform Fundamentals

The foundation of gomyfinance invest rests on four key pillars that ensure users have the best possible experience when building their wealth.

Online Investment Accessibility

The platform operates entirely online, eliminating the need for physical branch visits or phone calls with brokers. Users can access their accounts 24/7 from anywhere with an internet connection. This flexibility means investors can respond to market opportunities in real-time, whether they’re at home, at work, or traveling.

Low Minimum Investment ($10 Requirement)

One of the most significant barriers to entry for new investors has traditionally been high minimum deposits. Gomyfinance invest shatters this barrier by requiring only $10 to get started. This nominal amount allows anyone to begin their investment journey, regardless of their current financial situation. Students can start with spare change from their part-time jobs, while young professionals can dip their toes into investing without a significant financial commitment.

User-Friendly Interface Design

The platform’s interface prioritizes simplicity without sacrificing functionality. Clean layouts, intuitive navigation, and clear labeling ensure users can find what they need quickly. Even those with limited technical skills find the platform easy to navigate. The dashboard presents critical information at a glance, with deeper analysis just a click away.

Mobile and Web Accessibility

Recognizing that modern investors need flexibility, gomyfinance.com invest offers both mobile apps and web-based access. The mobile application provides full functionality, allowing users to monitor portfolios, execute trades, and access educational content on the go. The web platform offers expanded screen real estate for detailed analysis and research.

Available Investment Options

Diversification forms the cornerstone of a sound investment strategy, and the platform delivers an impressive array of asset classes.

Stocks and Equities

Users can invest in individual company stocks across various exchanges. From blue-chip corporations to emerging growth companies, the platform provides access to thousands of equities. Research tools help users analyze company fundamentals, technical indicators, and analyst recommendations before making decisions.

Bonds

For those seeking more stable, income-generating investments, the platform offers access to government and corporate bonds. Users can build laddered bond portfolios to create steady income streams while preserving capital.

ETFs (Exchange-Traded Funds)

Exchange-traded funds provide instant diversification at low costs. Gomyfinance invest features hundreds of ETFs covering various sectors, geographies, and investment strategies. Whether users want exposure to technology, healthcare, international markets, or specific themes like clean energy, they’ll find relevant ETF options.

Mutual Funds

Traditional mutual funds remain popular for hands-off investors who prefer professional management. The platform curates a selection of top-performing mutual funds across different risk profiles and investment objectives.

Cryptocurrency

Recognizing the growing interest in digital assets, the platform includes cryptocurrency trading. Users can invest in major cryptocurrencies like Bitcoin and Ethereum, along with select altcoins. Educational resources help users understand the unique risks and opportunities in this volatile asset class.

Real Estate Investment Options

Real estate investing becomes accessible through REITs (Real Estate Investment Trusts) and real estate crowdfunding opportunities. Users can gain exposure to commercial properties, residential developments, and specialized real estate sectors without the challenges of direct property ownership.

Key Platform Features

Beyond basic trading capabilities, gomyfinance invest incorporates sophisticated features that enhance the investment experience.

Real-Time Market Data and Updates

The platform streams live market data, ensuring users always have current information when making decisions. Price quotes update in real-time, and breaking news affecting markets appears instantly on user dashboards.

Automated Portfolio Management

For users preferring a hands-off approach, automated portfolio management handles asset allocation, rebalancing, and tax-loss harvesting. The system adjusts holdings based on user-defined risk tolerance and goals.

AI-Powered Investment Recommendations

Artificial intelligence analyzes market conditions, user preferences, and financial goals to generate personalized investment recommendations. These suggestions help users discover opportunities they might otherwise miss while staying aligned with their overall strategy.

Portfolio Tracking Tools

Comprehensive tracking tools show portfolio performance across multiple timeframes. Users can view returns daily, monthly, quarterly, or annually, with comparison benchmarks against major indices like the S&P 500.

Market Analysis and Insights

The platform aggregates analysis from various sources, presenting users with market commentary, sector trends, and economic indicators. This information helps users understand the broader context affecting their investments.

Risk Assessment Tools

Before making investment decisions, users can utilize risk assessment calculators that evaluate potential downside, volatility exposure, and how specific investments might impact their overall portfolio risk profile.

Educational Resources & Learning Tools

Education forms a crucial component of the gomyfinance.com invest experience, ensuring users make informed decisions rather than relying on speculation or tips.

Educational Materials

Video Tutorials for Beginners

The platform hosts an extensive library of video tutorials covering everything from opening an account to advanced trading strategies. These videos break down complex concepts into digestible segments, making learning engaging and accessible.

In-Depth Investment Guides

Written guides provide comprehensive coverage of investment topics. Users can learn about asset allocation, portfolio theory, tax-efficient investing, and specific investment vehicles at their own pace.

Expert Market Analysis Blogs

Regular blog posts from financial experts offer timely analysis of market conditions, sector trends, and investment strategies. These articles help users develop their analytical skills while staying informed about relevant market developments.

Webinars and Live Sessions

Interactive webinars allow users to learn from investment professionals and ask questions in real-time. These sessions cover trending topics, platform features, and investment strategies tailored to different experience levels.

Financial Terminology Explanations

A comprehensive glossary demystifies financial jargon. Users can quickly look up unfamiliar terms, ensuring they fully understand investment concepts and recommendations.

Community Engagement

Learning extends beyond formal educational content through community interaction.

Community Forums

Active forums connect users with peers facing similar financial questions and goals. Members share experiences, discuss strategies, and support each other’s investment journeys.

Peer-to-Peer Insights Sharing

Users can share portfolio strategies, investment ideas, and lessons learned. This collaborative environment fosters collective learning and helps members avoid common pitfalls.

Expert Investor Advice Access

Experienced investors and financial professionals contribute to discussions, offering guidance based on real-world experience. This mentorship aspect accelerates learning for newer investors.

Interactive Learning Environment

The combination of forums, live chats, and social features creates an engaging learning ecosystem where users feel supported and motivated to improve their financial literacy.

Technology & Automation

Gomyfinance invests leverages cutting-edge technology to simplify investing and enhance results.

Robo-Advisors

Automated Investing Features

Robo-advisors handle investment decisions based on user parameters, eliminating emotional decision-making that often leads to poor outcomes. These automated systems operate continuously, monitoring portfolios and making adjustments as needed.

Algorithm-Based Recommendations

Sophisticated algorithms analyze thousands of data points to generate investment recommendations tailored to individual circumstances. These recommendations consider risk tolerance, time horizon, and financial goals.

Portfolio Rebalancing

As markets fluctuate, portfolios drift from target allocations. The automated system regularly rebalances holdings, selling overweighted positions and buying underweighted ones to maintain desired risk levels.

Advanced Analytics

Market Trend Analysis

The platform’s analytics engine identifies emerging trends across asset classes, sectors, and geographies. Users gain insights into momentum, reversal patterns, and cyclical movements that inform better timing decisions.

Historical Performance Data

Comprehensive historical data allows users to backtest strategies and understand how investments performed during various market conditions. This historical context builds confidence in investment decisions.

Future Predictions and Forecasting

While no one can predict markets with certainty, the platform’s forecasting tools use statistical models to project potential outcomes under different scenarios. These projections help users prepare for various possibilities.

Risk-Reward Calculations

Before entering positions, users can evaluate expected returns relative to risks. These calculations help ensure investments align with personal risk tolerance and return requirements.

Additional Financial Management Tools

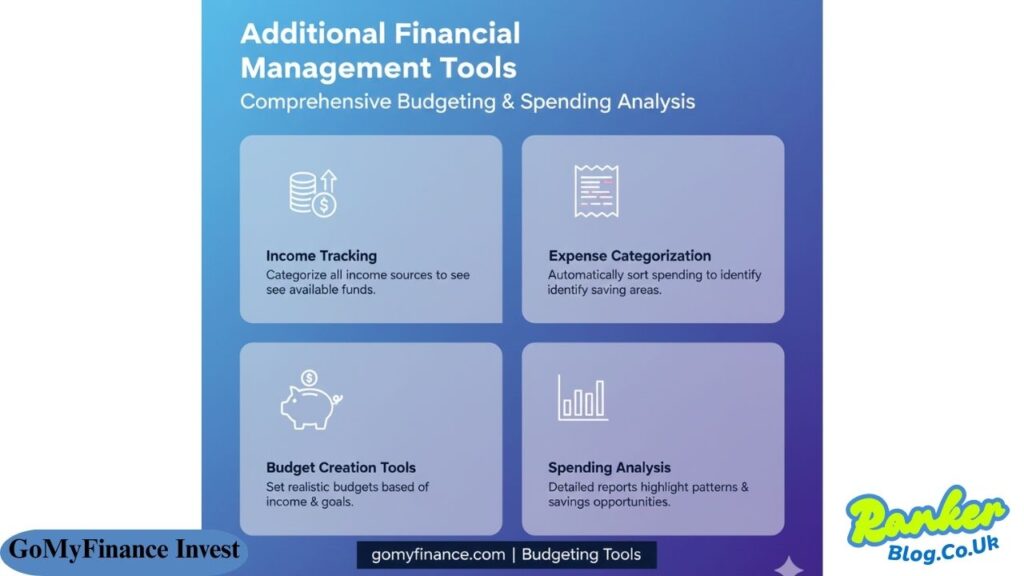

Gomyfinance.com invest recognizes that successful investing requires managing all aspects of personal finance, not just investment accounts.

Budgeting Features

Income Tracking

Users can input all income sources, creating a complete picture of available funds. The system categorizes income types and tracks patterns over time.

Expense Categorization

Every expense gets categorized automatically, showing users exactly where money goes each month. This visibility helps identify areas for potential savings that can be redirected toward investments.

Budget Creation Tools

Intuitive tools help users create realistic budgets based on their income and financial goals. The system suggests allocations across different spending categories while ensuring sufficient funds flow toward saving and investing.

Spending Analysis

Detailed reports analyze spending patterns, highlighting areas where users exceed budgets or have opportunities to reduce expenses. These insights directly impact how much users can invest through gomyfinance.com saving money strategies.

Credit Score Management

Credit Score Tracking (300-850 Range)

Users can monitor their credit scores directly through the platform, understanding this crucial number that affects loan rates, insurance premiums, and financial opportunities.

FICO Score 8 Components Breakdown

The platform explains how credit scores are calculated, breaking down the five components that comprise FICO scores. This education helps users understand which actions most impact their scores.

Payment History Monitoring (35% Weight)

Since payment history represents the largest component of credit scores, the platform emphasizes on-time payments. Reminders and tracking features help users maintain perfect payment records.

Debt-to-Credit Ratio Analysis (30% Weight)

Users can see how their credit utilization affects scores. The platform recommends optimal utilization percentages and strategies for improving this important ratio.

Tips for Improving Credit Scores

Actionable advice helps users boost credit scores through strategic actions like paying down high-interest debt, diversifying credit types, and avoiding hard inquiries.

Bill Management

Bill Tracking Features

All recurring bills get logged in one central location, preventing missed payments that could incur fees or damage credit scores.

Payment Reminders

Automated reminders ensure users never miss payment deadlines. Notifications arrive via email, text, or push notifications based on user preferences.

Debt Management Tools

For users carrying debt, specialized tools help create payoff strategies. Whether using debt avalanche, debt snowball, or hybrid approaches, the platform tracks progress and keeps users motivated.

Security & Compliance

Trust forms the foundation of any financial platform, and gomyfinance invest takes security seriously.

Security Measures

Bank-Level Encryption

All data transmissions use the same 256-bit encryption employed by major financial institutions. This military-grade security ensures personal and financial information remains protected from unauthorized access.

Two-Factor Authentication (2FA)

Users can enable two-factor authentication, adding an extra security layer beyond passwords. This feature significantly reduces unauthorized account access risks.

Know Your Customer (KYC) Verification

Comprehensive KYC procedures verify user identities, protecting against fraud and ensuring regulatory compliance. While this process requires some documentation, it ultimately protects all users.

Government ID Requirements

Identity verification requires government-issued identification, ensuring accounts belong to their rightful owners. This requirement prevents identity theft and account takeovers.

Regulatory Compliance

International Financial Regulations

The platform adheres to financial regulations across the jurisdictions where it operates, ensuring legal compliance and user protection.

SEC and FINRA Relationship (Not Affiliated)

While not directly affiliated with regulatory bodies like the SEC or FINRA, the platform operates within guidelines established by these organizations, maintaining transparency about its regulatory status.

Transparency in Policies and Fees

All fees, policies, and terms of service are clearly disclosed and easily accessible. Users never encounter surprise charges or hidden terms buried in fine print.

Data Protection Standards

User data receives protection under strict privacy policies. The platform doesn’t sell user information to third parties and limits data access to what’s necessary for service delivery.

Getting Started Guide

Beginning an investment journey with Gomyfinance Invest involves straightforward steps designed to get users invested quickly.

Account Setup Process

Registration Steps

Creating an account takes just minutes. Users provide basic information, including name, email, and contact details. The interface guides users through each step with clear instructions.

Identity Verification Requirements

After initial registration, users complete identity verification by uploading their government ID and potentially additional documentation. This process typically completes within 24-48 hours.

Initial Deposit Process

Once verified, users can make their first deposit. The minimum $10 requirement makes starting accessible to virtually everyone. Multiple funding methods accommodate different preferences.

Account Funding Options

Users can fund accounts via bank transfers, debit cards, credit cards (in some cases), or electronic payment services. Transfers typically process within 1-3 business days, though some methods offer instant funding.

Creating Your Investment Strategy

Assessing Risk Tolerance

The platform guides users through questionnaires that determine their comfort with market volatility. Understanding risk tolerance ensures investment strategies align with psychological comfort levels.

Setting Financial Goals

Clear goals drive successful investing. Users define specific objectives like retirement savings, home down payments, or education funding. The platform helps quantify these goals with target amounts and timeframes.

Choosing Investment Mix

Based on risk tolerance and goals, users select their preferred mix of stocks, bonds, and other assets. The platform suggests allocations but allows customization to match personal preferences.

Portfolio Diversification Strategies

Education about diversification helps users understand why spreading investments across multiple assets reduces risk. The platform recommends diversification levels appropriate for portfolio sizes and goals.

Making Your First Investment

Platform Navigation

Tutorials walk new users through the interface, showing where to find research tools, execute trades, and monitor portfolios. This orientation reduces learning curves and builds confidence.

Selecting Assets

Research tools help users evaluate potential investments. Screening filters narrow thousands of options to those matching specific criteria like market cap, dividend yield, or growth rates.

Executing Trades

Placing orders is straightforward. Users specify what to buy, how much, and order types (market or limit). The system confirms details before execution, preventing accidental trades.

Monitoring Performance

After investing, users can track performance through portfolio dashboards showing current values, gains/losses, and percentage returns. Customizable views let users focus on the metrics most important to them.

Investment Strategies & Performance

Gomyfinance invest not only provides investment tools but also educates users about proven strategies for building wealth.

Platform Performance Metrics

Q1 2025 Returns: 4.22% vs S&P 500’s 1.44%

Early performance data shows promising results, with the platform’s automated portfolios delivering 4.22% returns in Q1 2025, significantly outperforming the S&P 500’s 1.44% return during the same period. While past performance doesn’t guarantee future results, these metrics demonstrate the platform’s potential.

User Success Stories

Real users share their experiences, from paying off debt through disciplined investing to building six-figure portfolios over time. These stories inspire newcomers and validate the platform’s approach.

Performance Tracking Methods

Transparent tracking shows returns across different timeframes and compares performance against relevant benchmarks. Users can see exactly how their investments perform relative to market indices and stated goals.

Recommended Investment Approaches

90/10 Strategy (Warren Buffett Approach)

The platform explains Warren Buffett’s recommended allocation for most investors: 90% in low-cost stock index funds and 10% in short-term government bonds. This simple strategy has historically delivered strong returns with reasonable risk.

Dollar-Cost Averaging

Rather than trying to time markets, dollar-cost averaging involves investing fixed amounts at regular intervals. This approach reduces the impact of market volatility and removes emotional decision-making from investing.

Long-Term vs Short-Term Strategies

Education helps users understand the differences between long-term wealth building and short-term trading. Most guidance emphasizes long-term approaches that have historically proven more successful for average investors.

Risk-Based Asset Allocation

The platform helps users understand how age, goals, and circumstances should influence asset allocation. Younger investors typically handle more risk, while those nearing retirement need more conservative approaches.

Building Diversified Portfolios

Asset Class Diversification

Spreading investments across stocks, bonds, real estate, and commodities reduces portfolio volatility. The platform explains optimal diversification levels for different portfolio sizes.

Risk Management Techniques

Beyond diversification, users learn about position sizing, stop losses, and hedging strategies that protect portfolios during downturns.

Rebalancing Strategies

Markets cause portfolio drift over time. The platform teaches when and how to rebalance, either through automated features or manual adjustments, maintaining target allocations.

Costs & Fees

Transparent pricing makes gomyfinance.com invest attractive to cost-conscious investors.

Fee Structure

Commission-Free Trades

Stock and ETF trades execute without commissions, allowing users to trade frequently without fees eroding returns. This feature particularly benefits smaller accounts where commissions would represent significant percentages of investments.

Low Automated Portfolio Fees

Robo-advisor services charge modest annual fees based on account balances, typically ranging from 0.25% to 0.50%—significantly below traditional advisor fees of 1% or more.

Transparent Pricing Model

All fees are disclosed upfront, with no hidden charges. Users know exactly what they’ll pay before opening accounts.

No Hidden Charges

Unlike some platforms that profit from unclear fee structures, gomyfinance invest operates transparently, building trust with users who appreciate straightforward pricing.

Minimum Investment Requirements

$10 Minimum for Getting Started

The rock-bottom minimum makes starting accessible to virtually everyone. This low barrier encourages people to begin investing immediately rather than waiting until they’ve accumulated larger amounts.

Asset-Specific Minimums

While the overall minimum is $10, some specific investments like mutual funds might have higher minimums. The platform clearly communicates these requirements.

Accessibility for Small Investors

By keeping barriers low, the platform ensures that students, young professionals, and others with limited capital can participate in wealth-building opportunities.

Platform Advantages

Understanding what sets gomyfinance invest apart helps users appreciate the value they receive.

Competitive Differentiators

Comparison with Other Platforms

While platforms like myinvestments.com and goldinvestments.co.uk offer investment services, gomyfinance.com invest distinguishes itself through comprehensive financial management tools beyond basic investing.

Integration of Budgeting and Investing Tools

The seamless integration of budgeting, credit monitoring, and investing creates a unified financial experience. Users don’t need multiple platforms for different financial needs.

Lower Barriers to Entry

The $10 minimum and commission-free trading remove traditional obstacles that prevented many from investing. This accessibility expands opportunity to broader audiences.

User Benefits

Accessibility for All Experience Levels

Whether someone is opening their first investment account or managing complex portfolios, the platform accommodates all skill levels without compromising functionality.

Comprehensive Financial Management

The all-in-one approach means users spend less time jumping between different financial apps and more time actually improving their financial situations.

Educational Empowerment

Extensive educational resources empower users to make informed decisions rather than depending entirely on automated recommendations or external advisors.

Community Support System

The engaged user community provides motivation, accountability, and shared learning that accelerates financial growth.

Customer Support

Quality support ensures users get help when needed, reducing frustration and building confidence.

Support Channels

24/7 Availability

Support operates around the clock, recognizing that financial questions and issues don’t respect business hours.

Live Chat Support

Instant messaging with support representatives provides quick answers to common questions without waiting on hold.

Email Assistance

For less urgent inquiries or complex issues requiring detailed explanations, email support offers thoughtful, comprehensive responses.

Phone Support

Traditional phone support remains available for users preferring voice conversations or dealing with sensitive account matters.

Additional Resources

FAQ Section

Comprehensive FAQs answer common questions about account setup, platform features, and investment strategies. Most users find answers without contacting support.

Help Center

The organized help center categorizes information logically, allowing users to quickly navigate to relevant topics.

Tutorial Library

Video and written tutorials cover every platform feature, ensuring users can learn independently at their convenience.

Risks & Disclaimers

Responsible investing requires understanding risks, and gomyfinance invest ensures users make informed decisions.

Investment Risks

Market Volatility

All investments carry risk, and market values fluctuate. The platform educates users about volatility and how it affects different asset classes.

Potential Loss of Principal

Users must understand they could lose money, including their initial investment. While markets have historically risen over long periods, short-term losses occur regularly.

Past Performance Disclaimer

Historical returns don’t guarantee future results. The platform consistently reminds users that previous performance, whether platform-specific or market-wide, doesn’t predict future outcomes.

No Guaranteed Returns

Unlike insured bank accounts, investments don’t guarantee returns. The platform clearly communicates this fundamental aspect of investing.

Platform Limitations

Not a Registered Investment Advisor

The platform clarifies that it doesn’t provide personalized investment advice as a registered advisor would. Tools and educational content serve informational purposes.

Educational vs Professional Advice

While educational resources provide valuable information, they don’t replace personalized advice from licensed financial professionals who understand individual circumstances.

User Responsibility for Decisions

Ultimately, users make their own investment decisions and bear responsibility for outcomes. The platform provides tools and information, but doesn’t dictate specific actions.

Recommendation to Consult Licensed Professionals

For complex financial situations or major financial decisions, the platform recommends consulting certified financial planners or investment advisors.

Who Should Use GoMyFinance Invest

Understanding ideal users helps people determine if the platform fits their needs.

Ideal User Profiles

Beginning Investors

People taking their first steps into investing find the platform welcoming and educational. Low minimums and extensive guidance make starting less intimidating.

Young Professionals and Students

Those early in their careers benefit from starting investment habits early. The platform’s affordability and educational focus suit younger demographics perfectly.

Experienced Traders Seeking Tools

Even seasoned investors appreciate the platform’s research tools, automated features, and integrated financial management.

Budget-Conscious Investors

Anyone wanting to maximize returns by minimizing fees finds the commission-free trading and low management costs appealing.

Use Case Scenarios

Building Emergency Funds

While emergency funds typically reside in savings accounts, users can maintain portions in liquid, low-risk investments for better returns while preserving accessibility.

Retirement Planning

Long-term retirement savings benefit from the platform’s automated portfolio management and tax-advantaged account options.

Wealth Accumulation

Users focused on building wealth appreciate the combination of investment options, research tools, and educational resources.

Financial Literacy Development

The platform serves as an excellent learning environment where users develop financial skills through education and hands-on experience.

Conclusion: Your Financial Future Starts Here

Gomyfinance invest represents more than just another investment platform—it’s a comprehensive financial partner designed to support users throughout their wealth-building journey. By combining accessible investing with budgeting tools, educational resources, and community support, the platform addresses the complete spectrum of financial needs.

Platform Summary and Value Proposition

The platform’s greatest strength lies in its holistic approach. Rather than treating investing as an isolated activity, gomyfinance.com invest recognizes that successful wealth building requires managing all financial aspects—from daily spending to long-term investment strategy. The $10 minimum removes traditional barriers, while educational resources ensure users make informed decisions rather than blindly following tips or trends.

Future of Digital Investing

As technology continues to transform finance, platforms that prioritize accessibility, education, and transparency will thrive. Gomyfinance invest itself at this movement’s forefront, proving that powerful financial tools don’t need to be complicated or expensive. The integration of AI-powered recommendations, automated portfolio management, and comprehensive financial tracking represents where the industry is heading.

Final Recommendations

For anyone considering their investment options, gomyfinance.com invest deserves serious consideration. The combination of low costs, extensive educational resources, and integrated financial management creates exceptional value. Begin with the minimum $10 deposit, explore the educational materials, and gradually increase investments as comfort and knowledge grow. Remember that consistent, disciplined investing over time typically outperforms attempts to time markets or chase hot tips.

Call to Action: Starting Your Investment Journey

The best time to start investing was yesterday; the second-best time is today. With gomyfinance invest, beginning your journey requires just $10 and a few minutes to create an account. The platform handles the complexity while you focus on building wealth and securing your financial future. Whether goals include retirement security, financial independence, or simply growing wealth, the tools and support needed for success are available. Take that first step today—your future self will thank you.

Frequently Asked Questions

Common Questions About Account Setup

How long does account verification take?

Most account verifications are complete within 24-48 hours after submitting the required documentation. Some cases requiring additional verification might take slightly longer.

What documents do I need to open an account?

Users need government-issued photo identification (driver’s license or passport) and proof of address. Some situations might require additional documentation.

Can I open multiple accounts?

Yes, users can open different account types (individual, retirement, joint) based on their needs, though each requires separate verification.

Investment Strategy Questions

How much should I invest initially?

While the minimum is $10, investing what’s affordable without impacting essential expenses is wise. Many users start with $50-$100 and increase their contributions as their financial situations improve.

Should I use automated investing or pick my own investments?

Beginners often benefit from automated options while learning, then transition to self-directed investing as knowledge grows. The platform supports both approaches.

How often should I check my portfolio?

While the platform allows constant monitoring, checking monthly or quarterly often suffices for long-term investors. Excessive monitoring can lead to emotional decisions.

Security and Safety Concerns

How does the platform protect my money?

Funds receive protection through various measures, including encryption, segregated accounts, and regulatory compliance. Specific protections depend on account types and jurisdictions.

What happens if the platform experiences technical issues?

While rare, technical issues occasionally occur. The platform maintains robust backup systems and customer support to address problems quickly. User funds remain secure during outages.

Can someone else access my account?

With proper security measures like strong passwords and two-factor authentication enabled, unauthorized access becomes extremely difficult.

Technical Support Inquiries

How do I contact customer support?

Multiple channels are available, including live chat, email, and phone. The FAQ section and help center also answer many common questions.

Is there a mobile app?

Yes, fully-functional mobile apps exist for both iOS and Android devices, providing complete access to all platform features.

Can I import data from other investment accounts?

Many users can import historical data from other platforms, though specific compatibility depends on the previous platform’s export capabilities.

Fee and Cost Questions

Are there any hidden fees?

No. The platform prides itself on transparent pricing with all fees clearly disclosed upfront. What you see is what you pay.

How do commission-free trades work?

The platform generates revenue through other means, like interest on cash balances and premium features, allowing commission-free stock and ETF trading.

Will fees increase in the future?

While the platform maintains current fee structures, changes could occur with advance notice. Users would be informed of any pricing changes before implementation.

Also Read: How to Build Financial Stability Even on a Tight Budget