Introduction to QLCredit

The financial landscape has transformed dramatically over the past decade, with digital platforms revolutionizing how people access credit and manage their financial health. QLCredit stands at the forefront of this transformation, offering a modern approach to lending that combines technology with accessibility.

As traditional banking systems struggle to serve everyone efficiently, platforms like QLCredit have emerged to bridge the gap. The company represents a new generation of financial services that prioritize speed, transparency, and inclusion. Understanding how these platforms work and how they differ from conventional lending institutions can help borrowers make informed decisions about their financial future.

The fintech revolution has democratized access to credit, allowing more people to participate in the financial system. QLCredit’s mission centers on providing fast, transparent, and accessible lending solutions while helping users understand and improve their creditworthiness. For anyone looking to understand where to check my credit score or access lending services, exploring what QLCredit offers provides valuable insights into modern financial tools.

What is QLCredit?

QLCredit operates as a digital credit platform that leverages technology to streamline the lending process. Unlike traditional banks that rely heavily on physical branches and paper-based systems, this platform functions entirely online, making financial services accessible from anywhere with an internet connection.

The platform’s technology-driven approach uses advanced algorithms and data analytics to assess creditworthiness. This methodology allows for faster decision-making and often provides opportunities for individuals who might struggle to qualify through conventional banking channels. The system evaluates various data points beyond traditional credit scores, creating a more comprehensive picture of a borrower’s financial situation.

QLCredit primarily serves two distinct audiences: individual borrowers seeking personal loans and small to medium enterprises (SMEs) needing business financing. This dual focus allows the platform to address various financial needs, from emergency personal expenses to business expansion capital.

What sets QLCredit apart from traditional banking lies in its speed, accessibility, and user experience. The platform eliminates much of the bureaucracy associated with conventional lending, offering decisions in minutes rather than weeks. Additionally, the entirely digital interface means no waiting in lines or scheduling appointments with loan officers.

Core Features and Services

AI-Powered Credit Assessment

One of QLCredit’s most innovative features involves its artificial intelligence-powered credit evaluation system. Traditional lenders typically rely heavily on credit reports from the 3 major credit reporting agencies: Equifax, Experian, and TransUnion. While QLCredit considers these reports, the platform goes further by incorporating alternative credit scoring models.

The system analyzes real-time behavioral data, examining patterns in how applicants manage their finances beyond what appears on standard credit reports. Machine learning algorithms continuously improve the assessment process, learning from thousands of lending decisions to better predict creditworthiness and appropriate loan terms.

This approach proves particularly beneficial for individuals with limited credit history or those who have experienced financial setbacks. The platform recognizes that credit scores don’t tell the complete story, and other factors can indicate financial responsibility.

Fast Approval and Disbursement

Speed represents a critical advantage of digital lending platforms. QLCredit’s approval process typically operates on a minutes-based decision timeline rather than the days or weeks required by traditional institutions. Once approved, funds often become available on the same day, providing crucial assistance for time-sensitive financial needs.

This rapid turnaround stems from automated systems that can process applications and verify information almost instantaneously. The technology eliminates manual review bottlenecks that slow down conventional lending processes.

Flexible Repayment Options

Understanding that different borrowers face different financial circumstances, QLCredit offers customizable repayment schedules. Borrowers can choose weekly, biweekly, or monthly payment plans based on their income patterns and preferences. The platform also provides income-aligned payment plans that adjust to a borrower’s financial capacity.

This flexibility helps borrowers manage their debt more effectively and reduces the risk of default. When repayment terms align with income schedules, borrowers find it easier to meet their obligations consistently.

Transparent Fee Structure

One common complaint about both traditional and alternative lenders involves hidden fees and unclear terms. QLCredit addresses this concern by maintaining a transparent fee structure with no hidden charges. All costs associated with borrowing appear clearly before applicants accept the loan terms.

The platform provides detailed breakdowns of interest rates, processing fees, and total repayment amounts. This transparency allows borrowers to make informed decisions and understand exactly what their loan will cost over its lifetime.

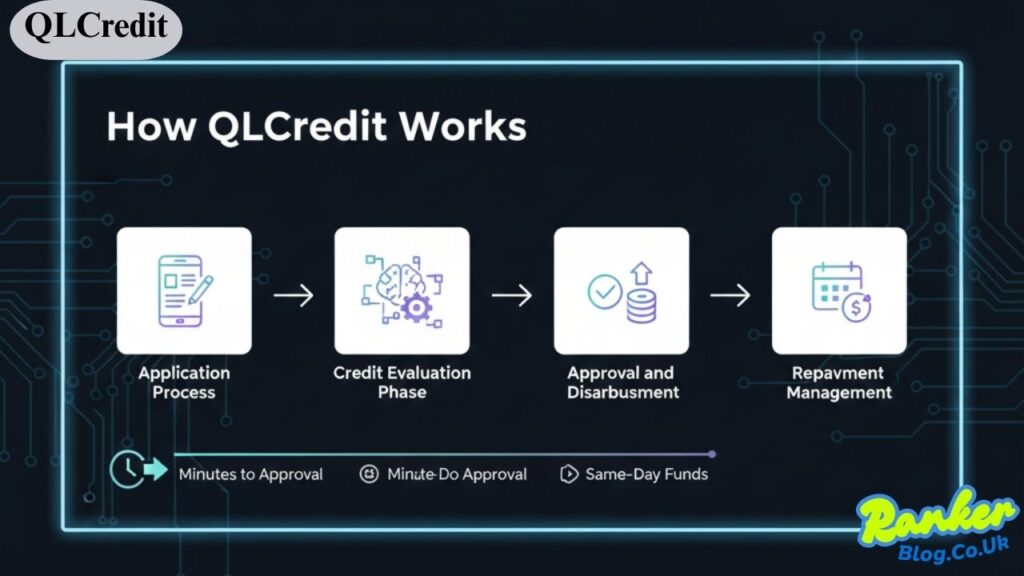

How QLCredit Works

Application Process

Getting started with QLCredit begins with a straightforward online or mobile application. The platform requires basic personal information, employment details, and banking information. Required documentation typically includes identification, proof of income, and sometimes bank statements.

The entirely digital submission process means applicants can complete their applications from home without gathering physical paperwork or visiting an office. The system guides users through each step, making it accessible even for those with limited technical experience.

Credit Evaluation Phase

Once an application is submitted, QLCredit’s AI-driven risk assessment system evaluates the borrower’s creditworthiness. The platform assesses alternative data points beyond traditional metrics, creating a more nuanced understanding of financial health. For those wondering how to get my credit report information into the system, the platform typically accesses this data directly through secure connections with credit bureaus.

The evaluation considers factors such as employment stability, income consistency, existing debt obligations, and payment history across various financial products. This comprehensive approach aims to provide fair assessments for a broader range of applicants.

Approval and Disbursement

Following evaluation, applicants receive prompt notification of their loan decision. Approved borrowers see their loan terms, including the amount approved, interest rate, fees, and repayment schedule. Once terms are accepted, the disbursement process begins immediately.

Fund transfer methods vary but typically include direct deposit to the borrower’s bank account. Timeline expectations usually range from within hours to one business day, significantly faster than traditional lending channels.

Repayment Management

QLCredit provides various payment options to accommodate different preferences. Borrowers can set up automatic payments, make manual payments through the platform, or use other approved methods. The system includes monitoring tools that track payment history, upcoming due dates, and remaining balance.

These management features help borrowers stay on top of their obligations and avoid missed payments. Many platforms also offer reminders and notifications to ensure borrowers never forget upcoming due dates.

Benefits of Using QLCredit

Speed and Convenience

The most immediately apparent benefit involves the speed of the entire process. From application to fund receipt, the timeline compresses from weeks to hours in many cases. This convenience proves invaluable during financial emergencies when time matters most.

The digital nature of the platform also means borrowers can apply whenever convenient, without worrying about business hours or geographical limitations. Everything happens online, eliminating travel time and scheduling complications.

Financial Inclusion for Underbanked Populations

Traditional banking systems often fail to serve certain populations effectively. Those with limited credit history, unconventional employment situations, or previous financial difficulties frequently face rejection from conventional lenders. QLCredit’s alternative assessment methods provide pathways to credit for these underbanked individuals.

By considering factors beyond traditional credit scores, the platform opens financial opportunities for people who might otherwise remain excluded from formal lending systems. This inclusion helps individuals build financial stability and work toward long-term economic security.

Accessibility for Limited Credit History

Young adults, recent immigrants, and others just beginning their financial journeys often struggle to access credit through traditional channels. The classic catch-22 of needing credit to build credit creates significant barriers. QLCredit’s willingness to consider alternative data helps these individuals access their first loans and begin building positive credit histories.

Understanding where to check my credit score becomes particularly important for these users, as monitoring progress helps maintain motivation and track improvement over time.

User-Friendly Digital Interface

Modern digital platforms prioritize user experience, and QLCredit exemplifies this approach. The interface features intuitive navigation, clear instructions, and helpful guidance throughout the process. Users don’t need technical expertise or a financial background to navigate the platform successfully.

Mobile optimization ensures the platform works seamlessly on smartphones, recognizing that many users primarily access financial services through mobile devices. This accessibility broadens the platform’s reach and usefulness.

Competitive Interest Rates

While alternative lenders sometimes charge higher rates than traditional banks, competitive platforms like QLCredit work to keep rates reasonable. The efficiency of automated systems reduces operational costs, allowing the platform to pass some savings to borrowers through more favorable rates.

Transparency about rates also empowers borrowers to compare options and make cost-effective decisions. Understanding the true cost of borrowing helps users avoid taking on unmanageable debt.

No Collateral Requirements

Traditional secured loans require borrowers to pledge assets as collateral, risking loss of property if they cannot repay. QLCredit typically offers unsecured lending options that don’t require collateral. This approach removes significant barriers for borrowers who lack assets to pledge but need access to credit.

Unsecured lending does carry a higher risk for lenders, which factors into interest rates, but the trade-off provides crucial access for many borrowers who would otherwise have no lending options.

QLCredit Ecosystem

Credit Education Hub

Beyond lending services, QLCredit recognizes the importance of financial literacy. The platform typically includes educational resources such as articles covering credit fundamentals, borrowing best practices, and financial planning strategies. Video tutorials provide visual learning options for different learning styles, while interactive tools help users practice concepts and see real-world applications.

These educational resources empower users to make better financial decisions beyond just borrowing. Understanding credit mechanics, interest calculations, and debt management strategies helps users avoid financial pitfalls and build stronger financial futures.

Credit Builder Tools

Many platforms include features specifically designed to help users improve their credit profiles. Score improvement guidance walks users through steps they can take to increase their creditworthiness over time. Monitoring features track changes and progress, providing motivation and clear feedback on financial behaviors.

For those exploring how to get my credit report and understand what it contains, these tools often provide explanations of different report elements and how various factors influence overall scores. This education demystifies credit systems and empowers users to take control of their financial health.

Users should know they can access a credit report for free through various channels, including AnnualCreditReport.com, which provides 3 free credit reports annually from each major bureau. Understanding this right helps users monitor their credit without unnecessary costs.

Micro-Investment Opportunities

Some digital platforms expand beyond lending to offer investment features. Peer-to-peer lending within the platform allows users with capital to earn returns by funding loans to other borrowers. This creates a community-based financial ecosystem where users can participate on both sides of the lending equation.

Passive income generation through these investment opportunities provides another financial tool for platform users. While these features carry their own risks, they represent innovative approaches to democratizing investment opportunities.

Target Markets and Use Cases

Individual Borrowers

Personal lending represents a significant portion of QLCredit’s services. Individual borrowers turn to the platform for various needs, including emergency expenses like medical bills or urgent home repairs. When unexpected costs arise, the fast approval and disbursement process provides crucial assistance.

Personal financial gaps between paychecks or during temporary income disruptions also drive borrowing. These short-term needs benefit from quick access and flexible repayment options. Additionally, some borrowers strategically use these loans for credit building, establishing positive payment history to improve their credit profiles.

Small and Medium Enterprises (SMEs)

Business borrowers face unique challenges accessing capital through traditional banks, which often require extensive documentation, long operating histories, and significant collateral. QLCredit’s streamlined approach makes business financing more accessible for entrepreneurs and small business owners.

Common business use cases include expansion financing for growing operations, working capital to manage cash flow fluctuations, and inventory financing to stock products for peak seasons. The faster approval process means businesses can seize opportunities without lengthy delays.

Underbanked Populations

Perhaps most importantly, QLCredit serves populations that traditional banking systems underserve or exclude entirely. Financial inclusion initiatives aim to bring more people into the formal financial system, providing them with tools for economic participation and advancement.

The platform offers alternatives to predatory lending options like payday loans, which often trap borrowers in cycles of debt. By providing more reasonable terms and transparent practices, QLCredit helps vulnerable populations access credit without exploitation.

Advantages Over Traditional Lending

Elimination of Bureaucracy

Traditional bank loans involve extensive paperwork, multiple approval layers, and complex processes that frustrate borrowers and slow down access to funds. QLCredit strips away much of this bureaucracy, focusing on what truly matters for assessing creditworthiness and processing loans.

The streamlined approach respects borrowers’ time and reduces frustration associated with traditional lending. Simplified processes also reduce opportunities for errors and miscommunication that plague more complex systems.

Faster Processing Times

While speed has been mentioned throughout, its importance cannot be overstated. In financial emergencies, days or weeks of waiting for traditional loan approval can mean the difference between managing a crisis and facing serious consequences. QLCredit’s ability to provide decisions within minutes and funds within hours addresses this critical need.

More Inclusive Eligibility Criteria

Traditional banks maintain rigid eligibility requirements that automatically disqualify many applicants. QLCredit’s alternative assessment methodology creates pathways for more people to qualify. This inclusivity doesn’t mean abandoning responsible lending practices but rather recognizing that financial responsibility manifests in various ways.

Digital-First Approach

The entirely online nature of QLCredit eliminates geographical barriers and physical accessibility issues. Borrowers in rural areas without nearby bank branches enjoy the same access as urban residents. People with mobility challenges or demanding schedules can apply at their convenience without arranging transportation or time off work.

Transparency and Clarity

While transparency has been discussed regarding fees, it extends throughout the entire QLCredit experience. Clear communication about processes, requirements, and expectations sets appropriate borrower expectations and builds trust. This openness contrasts with the often opaque practices of traditional lenders who bury important details in fine print.

Potential Risks and Considerations

Higher Interest Rates Compared to Traditional Banks

Honesty requires acknowledging that alternative lenders frequently charge higher interest rates than traditional banks. Several factors contribute to this reality, including higher perceived risk, lack of collateral, and operational costs of maintaining advanced technology platforms.

Borrowers should carefully compare rates and consider whether the benefits of speed and accessibility justify potentially higher costs. In some situations, waiting longer for a traditional bank loan might save money, while in others, the immediate access provides value worth the additional cost.

Short Repayment Periods

Digital lending platforms often feature shorter repayment terms than traditional loans. While this means borrowers pay off debt faster and pay less total interest, it also creates higher monthly or periodic payment obligations. Borrowers must honestly assess whether they can manage these higher payments without creating financial strain.

Data Privacy and Security Concerns

Sharing financial information online always carries some risk. While reputable platforms implement strong security measures, no system is completely immune to breaches. Borrowers should research platforms’ security practices and ensure they feel comfortable with the protections in place.

Reading privacy policies helps users understand how their data will be used and shared. Legitimate platforms clearly explain data practices and give users control over their information.

Borrowing Responsibility

Easy access to credit can become problematic if borrowers don’t exercise discipline. The convenience of digital platforms might tempt some users to borrow more frequently or for amounts exceeding their actual needs. Responsible borrowing requires an honest assessment of necessity and repayment capacity.

Taking on debt should always be a carefully considered decision, not an impulse. Just because credit is available doesn’t mean it should be used.

Understanding Total Repayment Costs

Even with transparent fee structures, some borrowers fail to fully grasp total repayment costs. They focus on monthly payments without calculating the total amount they’ll pay over the loan’s lifetime. Understanding both periodic payment amounts and total costs helps borrowers make informed decisions and avoid unpleasant surprises.

Best Practices for Using QLCredit

Assessing Financial Needs Accurately

Before applying for any loan, borrowers should carefully determine exactly how much they need and why. Borrowing more than necessary wastes money on interest for unneeded funds, while borrowing too little might not solve the underlying problem.

Creating a detailed budget that accounts for the specific need helps establish the right loan amount. This planning should also consider whether alternatives to borrowing might better address the situation.

Understanding Terms Before Accepting

Borrowers must read and comprehend all loan terms before accepting offers. This includes interest rates, fees, repayment schedules, consequences of missed payments, and any other relevant conditions. Rushing through this step can lead to unexpected obligations or costs.

If any terms seem unclear, borrowers should seek clarification before proceeding. Reputable platforms provide customer support to answer questions and ensure borrowers understand what they’re agreeing to.

Calculating Total Repayment Amounts

Using online calculators or requesting detailed amortization schedules helps borrowers visualize the complete cost of borrowing. Seeing the total amount to be repaid, broken down by principal and interest, provides a crucial perspective on the loan’s true cost.

This calculation should factor into the decision about whether to borrow and how much to request.

Planning Repayment Strategy

Before receiving funds, borrowers should develop clear plans for repayment. This includes identifying income sources for payments, timing payments appropriately, and creating backup plans for potential financial disruptions.

Setting up automatic payments can help ensure on-time payment and avoid late fees. Building small payment buffers into budgets provides cushions against unexpected expenses that might otherwise derail repayment plans.

Building Credit Responsibly

For borrowers using QLCredit to establish or improve credit, consistent on-time payments are essential. Each successful payment contributes positively to credit history, while missed or late payments damage credit scores.

Borrowers should regularly monitor their progress by checking their credit scores and reviewing reports. Understanding where to check my credit score ensures users can track improvement and catch any errors that might appear on their reports. Remember that consumers can access a credit report for free to stay informed about their credit standing.

Technology and Security

Data Protection Measures

Reputable digital lending platforms invest heavily in protecting user data. This includes physical security for servers, network security protocols, and strict access controls limiting who within the organization can view sensitive information.

Regular security audits help identify and address potential vulnerabilities before they can be exploited. Platforms should be transparent about their security practices and willing to discuss how they protect user information.

Encryption and Security Protocols

All data transmission between users and platforms should use industry-standard encryption protocols. This ensures that even if data is intercepted during transmission, it remains unreadable to unauthorized parties.

Secure storage practices protect information once received, using encryption for stored data as well. Multi-factor authentication adds additional layers of protection against unauthorized account access.

Privacy Policies

Clear privacy policies explain how platforms collect, use, store, and share user information. These documents should be written in understandable language, not just legal jargon. Users should review privacy policies before sharing personal information with any platform.

Understanding what data is collected and how it might be shared helps users make informed decisions about whether they’re comfortable with a platform’s practices.

Compliance with Financial Regulations

Legitimate lending platforms operate within regulatory frameworks designed to protect consumers. Compliance with regulations ensures platforms maintain certain standards and provides recourse for borrowers if issues arise.

Borrowers should verify that platforms hold appropriate licenses for lending in their jurisdictions. Regulatory compliance indicates a platform takes its responsibilities seriously and operates with appropriate oversight.

The Future of Digital Lending

Fintech Adoption Trends

Digital financial services continue growing as more consumers become comfortable with online platforms. Younger generations, having grown up with digital technology, increasingly prefer online services over traditional banking. This demographic shift drives the continued expansion of platforms like QLCredit.

Technological improvements make these platforms more sophisticated and user-friendly over time. Enhanced AI capabilities, better security measures, and more intuitive interfaces all contribute to growing adoption.

QLCredit’s Role in Financial Democratization

By making credit more accessible to broader populations, platforms like QLCredit contribute to financial democratization. This movement toward inclusive financial systems helps reduce economic inequality and provides more people with tools for financial advancement.

As these platforms mature and refine their models, they may influence traditional banking to become more accessible and responsive to underserved populations. Competition from fintech companies pushes established institutions to innovate and improve their services.

Potential Innovations and Expansions

The future likely holds exciting developments in digital lending. Continued AI advancement may enable even more accurate credit assessments and personalized loan offerings. Integration with other financial services could create comprehensive financial management platforms combining lending, investing, budgeting, and education.

International expansion may bring these services to developing markets where traditional banking infrastructure is limited. Mobile-first approaches particularly benefit populations in regions where smartphones are more common than computers or bank branches.

Impact on the Traditional Banking Sector

Digital platforms force traditional banks to adapt or risk losing customers. Many established institutions now develop their own digital offerings or partner with fintech companies. This competition ultimately benefits consumers through improved services, better rates, and more options.

However, traditional banks still offer advantages like physical branches for complex transactions, established trust, and often lower interest rates for qualified borrowers. The future likely involves coexistence, with different institutions serving different needs and preferences.

Comparison with Competitors

Other Digital Lending Platforms

QLCredit operates in a competitive landscape with numerous alternative lending platforms. Competitors vary in their approaches, target markets, and specific offerings. Some focus exclusively on personal lending, while others specialize in business loans. Some serve specific niches like medical financing or education loans.

Borrowers benefit from comparing multiple platforms before choosing one. Factors to compare include interest rates, fees, repayment terms, approval speed, and user reviews. Different platforms may suit different needs, so what works best varies by individual circumstances.

Unique Value Propositions

What makes QLCredit stand out among competitors is its combination of speed, accessibility, and educational resources. The platform’s commitment to transparency and financial literacy sets it apart from competitors focused solely on transactions.

The balance between serving individual and business borrowers provides versatility that not all competitors offer. The comprehensive ecosystem approach, including education and credit-building tools, creates added value beyond simple loan transactions.

Market Positioning

QLCredit positions itself as an accessible, technology-driven lender committed to financial inclusion. This positioning appeals to borrowers who feel underserved by traditional banks and are attracted to platforms emphasizing transparency and education.

The platform’s focus on using technology to improve rather than simply speed up lending processes demonstrates a commitment to actually serving borrowers better, not just processing loans faster. This philosophical approach influences how the platform develops features and serves customers.

Customer Support and Resources

Support Channels

Quality customer support proves essential for digital platforms where users can’t walk into a branch for help. QLCredit typically provides multiple support channels, including email, phone support, and often live chat features. Response times and support quality significantly impact user experience.

The availability of support during extended hours accommodates users who can only address financial matters outside traditional business hours. Responsive, helpful support builds trust and helps users navigate any issues that arise.

Educational Materials

Beyond direct support, comprehensive educational resources empower users to help themselves. Well-organized FAQ sections address common questions, while detailed guides walk users through processes step-by-step. Video tutorials cater to visual learners who prefer watching demonstrations over reading instructions.

Blog content covering financial topics, borrowing strategies, and credit management provides ongoing value to users. These resources position the platform as a partner in financial health rather than simply a transaction facilitator.

FAQ and Troubleshooting

Searchable FAQ databases help users quickly find answers to specific questions without waiting for support responses. Common issues like password resets, payment problems, or application status inquiries often find resolution through self-service resources.

Troubleshooting guides for technical issues help users resolve problems independently when possible. Clear instructions with screenshots or videos make these resources accessible even for less tech-savvy users.

Community Features

Some platforms develop community features allowing users to connect, share experiences, and learn from one another. Forums or discussion boards can provide peer support and additional perspectives on managing credit and finances.

While community features add value, platforms must moderate these spaces appropriately to ensure information shared remains accurate and helpful rather than misleading or harmful.

Conclusion

QLCredit represents the evolution of lending in the digital age, combining technological innovation with a commitment to accessibility and financial inclusion. The platform addresses many limitations of traditional banking while providing valuable services to individuals and businesses alike.

The speed, convenience, and inclusive eligibility criteria make QLCredit an attractive option for many borrowers. The comprehensive ecosystem extending beyond simple lending to include education and credit-building tools demonstrates a holistic approach to financial services. For users wondering how to get their credit report or understand their credit standing, these platforms often provide valuable resources and connections to credit monitoring services.

However, borrowers must approach digital lending thoughtfully. Understanding the complete costs, carefully assessing needs, and borrowing responsibly remain crucial regardless of how convenient access becomes. The ease of online applications should never override careful financial planning and consideration.

The future of accessible credit looks promising, with continued technological advancement likely bringing even better services to more people. As platforms like QLCredit mature and competition drives innovation, consumers benefit from improved options for managing their financial needs.

For potential users considering QLCredit, the recommendation is to thoroughly research the platform, compare it with alternatives, and carefully read all terms before borrowing. Take advantage of educational resources to build financial knowledge alongside accessing credit. Remember that consumers are entitled to access 3 free credit reports annually from the 3 major credit reporting agencies, allowing regular monitoring without cost.

Whether QLCredit serves as a solution for immediate financial needs or a tool for building credit and financial knowledge, approaching it with informed awareness ensures the best possible outcome. The democratization of finance continues advancing, and platforms like QLCredit play important roles in making financial services more accessible, transparent, and user-friendly for everyone.

Also Read: Understanding Lender Processing A Complete Guide to Modern Mortgage Operations